29+ phh mortgage rates refinance

Web The lowest 30-year refinance rate will largely depend on your financial profile market conditions and the lender. Compare Best Refi Rates Today For 2023.

North America Mortgage Banking 2020 Convergent Disruption In The Cre

Among all lenders refinance loans including.

. Web PHH Mortgage offers a full range of refinancing options. On a national average the lowest rate was 641 for. Apply For a Home Loan Online Today.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. The average 30-year VA mortgage APR is 648 according to. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Ad Low Fixed Mortgage Refinance Rates Updated Daily. The Best Lenders All In 1 Place. Web Todays mortgage rates in Sheridan WY are 5679 for a 30-year fixed 4949 for a 15-year fixed and 5400 for a 5-year adjustable-rate mortgage ARM.

If you were eligible for HARP you may qualify for similar refinance programs. See How Competitive Your Mortgage Payment Could Be. Web On Sunday March 05 2023 the national average 30-year fixed refinance APR is 718.

Web The Lowdown On Rates. Ad Refinance today with other loan options to lower your monthly payment or consolidate debt. Web The vast majority over 98 of loans PHH Mortgage originated in 2021 were for refinancing and cash-out refinancing.

Consumers can take advantage of low interest rates in a wide rang of mortgage products. Our Trusted Reviews Help You Make A More Informed Refi Decision. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

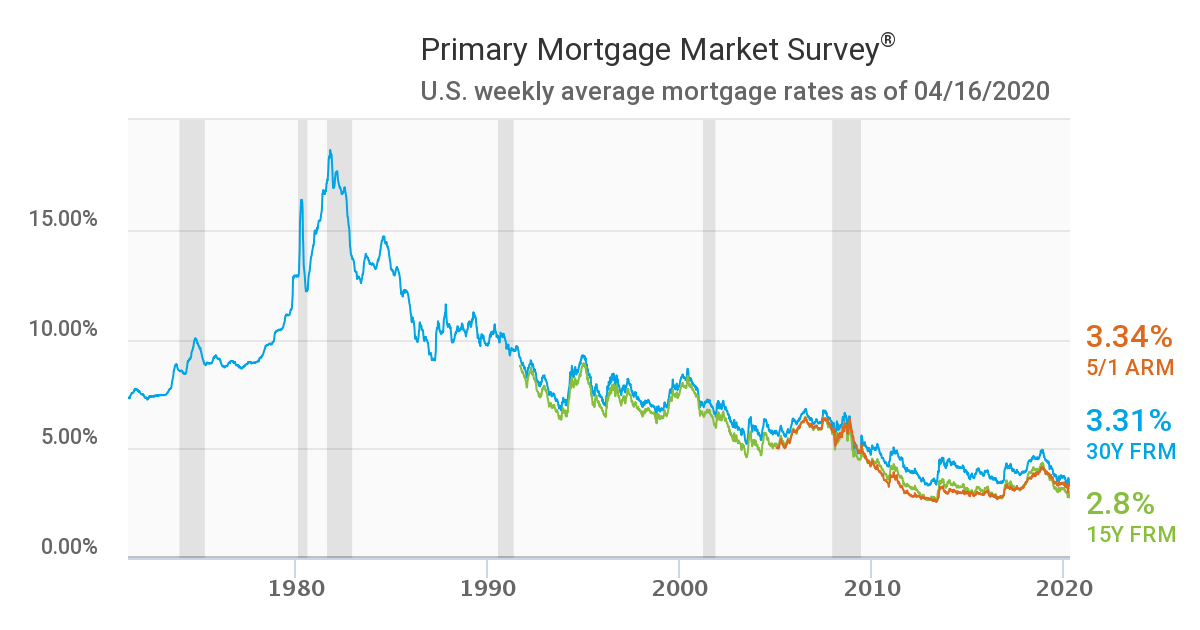

Web Rates may be 25 to 375 higher on refis but pay attention to points charged and loan assumptions. No SNN Needed to Check Rates. Web The national average annual percentage rate APR on a 30-year fixed mortgage refinance on December 3 2021 is 331 while the 15-year fixed mortgage.

Web For over 30 years PHH Mortgage has provided industry-leading mortgage services and helped countless homebuyers and homeowners find financing solutions to meet their. As with any other type of. Compare Best Refi Rates Today For 2023.

Simply enter your home location property value and loan amount to. Web On Wednesday March 08 2023 the national average 30-year VA refinance APR is 669. I looked around and found that Chase Citi and Wells.

Our Trusted Reviews Help You Make A More Informed Refi Decision. Ad Top Home Loans. The average 15-year fixed refinance APR is 644 according to Bankrates latest.

Ad Low Fixed Mortgage Refinance Rates Updated Daily. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The interest rate on your loan can impact the amount of money that you pay each month and over the life of your loan so naturally you want to get a.

The Best Lenders All In 1 Place. Ad Get Competitive Mortgage Rates And Expertise From Mortgage Experts. No SNN Needed to Check Rates.

Florida Mortgage Rates Today S Fl Mortgage Refinance Rates

Ocwen Mortgage Refinance Rates

Mortgage Rates Today For Refinance Better Mortgage

Phh Mortgage Corporation Mount Laurel Township Nj Yelp

Phh Mortgage Review March 2023 Finder Com

Mortgage Rates Have Moved Higher Off Of Record Lows For The Second Consecutive Week Tamra Wade Team Re Max Tru

Ocwen Financial Closes Transaction With Oaktree Citybiz

Today S Best Mortgage Refinance Rates For June 22 2020 Money

Plaza Home Mortgage Home Loans Refinance Mortgage Refinancing Mortgage Rates Home Equity Reverse Mortgages

Slight Increase In Mortgage Rates Takes Refi Potential Down A Peg National Mortgage News

Home Loans Northeastern Oh Mortgage Refinancing 7 17 Cu

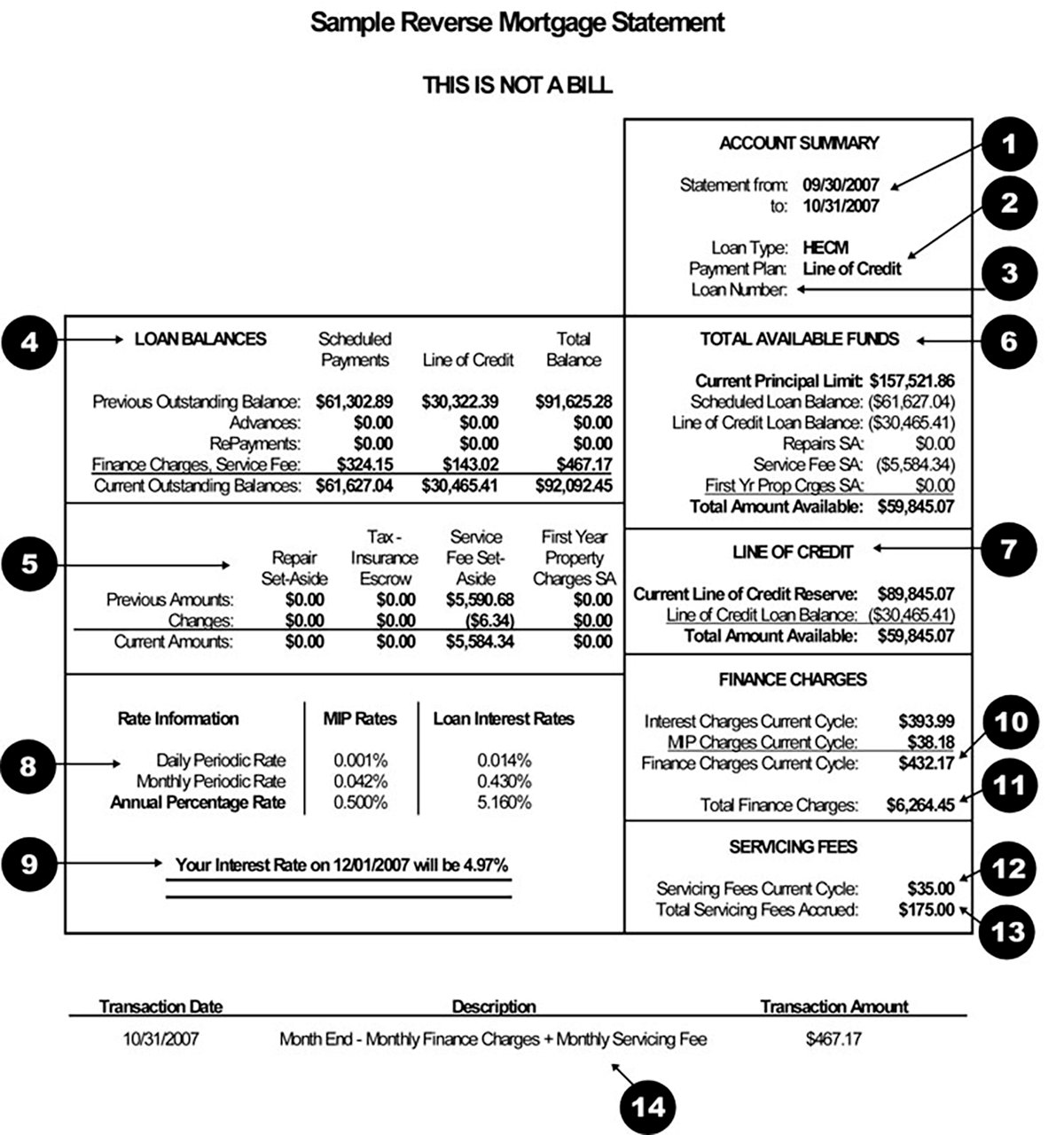

How To Understand Your Reverse Mortgage Statement

Should I Refinance Amidst Coronavirus Fallout 13 Million Homeowners Are Trying To Decide Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Rates Hold Steady Despite Sinking Bond Yields The Washington Post

Mortgage Rates Are Back Above 3 Here S Where They Re Headed Next Barron S

Why I Started Better Mortgage By Vishal Garg Better Mortgage

What Rising Interest Rates Mean For Orlando Homebuyers Realtors And The Housing Market Orlando Business Journal